President Biden Announces Intent to Nominate Martin O’Malley for Commissioner of the Social Security Administration

On July 26, 2023, President Biden announced his intent to nominate former Maryland Governor Martin O’Malley for Commissioner of the Social Security Administration. Below is an excerpt from President Biden’s, as taken from whitehouse.gov:

“Governor Martin O’Malley is a lifelong public servant who has spent his career making government more accessible and transparent, while keeping the American people at the heart of his work.

As Mayor of Baltimore and Governor of Maryland, he adopted data and performance-driven technologies to tackle complex challenges facing the communities he served – and I saw the results firsthand when we worked together during my time as Vice President. As Governor, he made government work more effectively across his administration and enhanced the way millions of people accessed critical services.”

You may be wondering, “What is the Commissioner’s job?” In a nutshell, the SSA Commissioner is directly responsible for all programs administered by SSA. You can read about this position and its responsibilities by clicking here. The Commissioner is appointed to serve a term of 6 years. The SSA has been without a Commissioner since President Biden fired then-Commissioner Andrew Saul, in July 2021.

You may be wondering, “What is the Commissioner’s job?” In a nutshell, the SSA Commissioner is directly responsible for all programs administered by SSA. You can read about this position and its responsibilities by clicking here. The Commissioner is appointed to serve a term of 6 years. The SSA has been without a Commissioner since President Biden fired then-Commissioner Andrew Saul, in July 2021.

HISTORY OF THE SSA

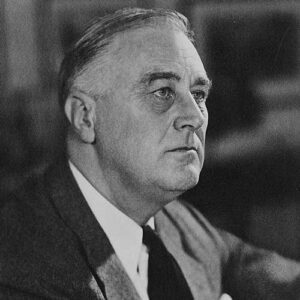

The United States Social Security Administration (SSA) was created as part of President Franklin D. Roosevelt’s New Deal with the signing of the Social Security Act of 1935 on August 14, 1935. The Board consisted of three presidentially appointed executives and started with no budget, no staff, and no furniture. It obtained a temporary budget from the Federal Emergency Relief Administration.

The first Social Security office opened in Austin, Texas, on October 14, 1936. Social Security taxes were first collected in January 1937, along with the first one-time, lump-sum payments. The first person to receive monthly retirement benefits was Ida May Fuller of Brattleboro, Vermont. She received her first check, dated January 31, 1940, for $22.54.

In 1939, the Social Security Board merged into a cabinet-level Federal Security Agency, which included the SSB, the U.S. Public Health Service, the Civilian Conservation Corps, and other agencies. In January 1940, the first regular ongoing monthly benefits began. In 1946, the SSB was renamed the Social Security Administration under President Harry S. Truman’s Reorganization Plan.

In 1953, the Federal Security Agency was abolished, and SSA was placed under the Department of Health, Education, and Welfare, which became the Department of Health and Human Services in 1980. In 1972, Cost of Living Adjustments (COLAs) were introduced into SSA programs to deal with the effects of inflation on fixed incomes. In 1994, Congress returned SSA to the status of an independent agency in the executive branch of government.

FUTURE OF THE SSA

Unless we have a crystal ball (and sadly, we do not), the future of SSA cannot be predicted. However, due to the changes made to Social Security in 1983, benefits are expected to be payable in full on a timely basis until 2037, when the trust fund reserves are projected to become exhausted. At the point where the reserves are used up, continuing taxes are expected to be enough to pay 76 percent of scheduled benefits. Thus, Congress will need to make changes to the scheduled benefits and revenue sources for the program in the future. The Social Security Board of Trustees project that changes equivalent to an immediate reduction in benefits of about 13 percent, or an immediate increase in the combined payroll tax rate from 12.4 percent to 14.4 percent, or some combination of these changes, would be sufficient to allow full payment of the scheduled benefits for the next 75 years.

“Reserves are used up.” “Reserves are projected to become exhausted.” These are some potentially scary terms. However, know that the attorneys and team members at Parmele Law Firm receive continual education on social security disability law, changes, and the effects of those changes on those we represent.

Our team of attorneys has over 120 years of combined Social Security disability experience. Why trust anyone else?

Our team of attorneys has over 120 years of combined Social Security disability experience. Why trust anyone else?

If you or someone you know needs assistance with an existing claim or has questions about beginning a claim, contact Parmele Law Firm to schedule your no-cost consultation. Parmele Law Firm. Guiding you with integrity, competency, and experience.